Most Popular Questions

Here are the questions members view the most

Showing 1- 10 of (162) results

-

A deductible is the amount you must pay each year for covered charges before benefits are paid by your plan.

What is a deductible?

Transcript

Health insurance jargon is confusing. We feel your pain.

And while there may not be a way around the word deductible, there is a way through it.

A deductible is the amount of money you have to pay before health insurance kicks in and starts paying for medical treatment and services.

This is Jill. Jill has a $1,000 annual deductible.

Let’s say Jill falls out of a tree and breaks her arm.

She goes to her In-Network doctor and gets a bill for $700.

Jill will pay all $700 herself.

She still has $300 bucks left to meet her annual deductible for the year.

No insurance help yet.

In June, Jill twists her ankle while walking her dog.

This time her bill is $500.

Since Jill only has $300 to go to meet her deductible, her insurance covers the remaining $200.

However, some plans may include coinsurance and that will change the amount you owe.

Jill has now meet her Deductible. For the remainder of the year, Jill won’t have to pay towards her deductible. Horizon will start paying for all eligible services with the exception of your copay and/or coinsurance.

But in January, it starts all over again.

It is important to know that your Deductible is different than your copayment and coinsurance. Not all plans include all three types of member responsibility.

In Jill’s case, she had a copayment at the time she visited her doctor to fix her ankle that she paid in addition to the $300 payment that went to the Deductible.

Your plan may have a deductible, copayment and/or coinsurance.

To learn more about your plan, how much you have contributed to your deductible this year, and to verify your deductible, copayment and/or coinsurance amounts, visit HorizonBlue.com/members.

You can also get answers to your questions by reading our FAQs, sending us a question through Message Center or asking a question through chat.

Was this helpful?

Last updated:

Feb 21,2024

Category:

Topics:

Audience:

-

Your EOB or Explanation of Benefits gives you an overview of the claim, including who provided the care, how much was billed, how much your plan covered, and how much you may owe.

After you visit a doctor, other health care professional, laboratory or hospital, an EOB is generated for you. If your health care provider participates in Horizon’s networks, the claim is submitted to Horizon for you. But if you go to an out-of-network health care provider, you may need to submit the claim yourself.

An EOB is not a bill. It tells you what costs are covered for medical care or services you’ve received.

View your EOBs 24/7 when you select Claims, then Statements of Payment.

Understanding Your Explanation of Benefits

Video Transcript

[“Understanding Your Explanation of Benefits” title and Horizon Blue Cross Blue Shield of New Jersey logo]

Each time you use your health plan to get care, you’ll get information about the claim your doctor submitted.

This information is called an “Explanation of Benefits” or EOB.

Your EOB gives you an overview of the claim, including who provided the care, how much was billed, how much your plan covered, and how much you may owe.

Your EOB also gives you detailed information about your claim.

This section lists additional information, including other insurance plan payments, if you have other coverage, and how much you are responsible for paying as a copay, coinsurance or deductible.

It also lists any “Amount Not Covered,” which may be costs billed by your doctor that are not covered by your plan.

All of these amounts are included in “What You Owe.”

Remember: Your EOB is not a bill, so don’t take out your checkbook just yet. Wait until you get a bill from your doctor to pay exactly what you owe.

You can view your EOBs, 24/7, by signing on to HorizonBlue.com or the Horizon Blue app.

If you have a question about your benefits or your EOB, sign in to HorizonBlue.com to email your question or chat with us, or give us a call. [1-800-355-BLUE (2583)]

To learn more, visit “What Happens After My Appointment” at HorizonBlue.com. [HorizonBlue.com/AfterMyAppointment]

[Horizon Blue Cross Blue Shield of New Jersey logo and disclaimer]

Sample Explanation of Benefits (EOB)

Terms used in an EOB

A. Date of Service: The date you received your care.

B. Type of Service: The service or care given to you by the provider.

C. Amount Billed: The amount charged by the provider for each service on the claim.

D. Allowed Amount: The amount the provider agrees to be paid for a specific service. It may include a deductible, coinsurance and/or copay.

E. Your Plan Paid: The total amount paid by Horizon BCBSNJ to you or the provider for the services that were covered by the plan.

F. Your Other Insurance Paid: The amount paid by another insurance carrier, if you are covered under another health insurance plan.

G. Copay: A copay is a fee that you pay each time you go to the provider. You pay the copay at the time you receive the care or service.

H. Coinsurance: The coinsurance is the amount you pay out-of-pocket after you have paid your deductible, if any. You pay the coinsurance amount directly to the provider.

I. Deductible: The amount you must pay before your plan pays for covered services. You are responsible for paying this amount directly to the provider.

J. Amount Not Covered: The fee charged for care that is not covered by your plan. You may be responsible for paying this amount in addition to any deductible, coinsurance and/or copay.

K. What You Owe: The total amount you owe the provider. The total amount includes:

- Any copay, coinsurance and/or deductible

- Costs for services you receive that are not covered by your plan

- The difference between the billed and paid amounts for out-of-network services

L. Claim Detail: These codes refer to specific messages for each claim that help explain how we processed your claim and calculated any payment.

Was this helpful?

Last updated:

Feb 21,2024

Category:

Topic:

Audience:

Related FAQs

- How can I update my information about additional insurance/coordination of benefits so I know my claim will be processed correctly?

- What does it mean if my claim was denied for benefit or service excluded?

- What is a deductible?

- What is a copayment?

- What is coinsurance?

- Why can’t I view all of the information of another member on my policy online?

-

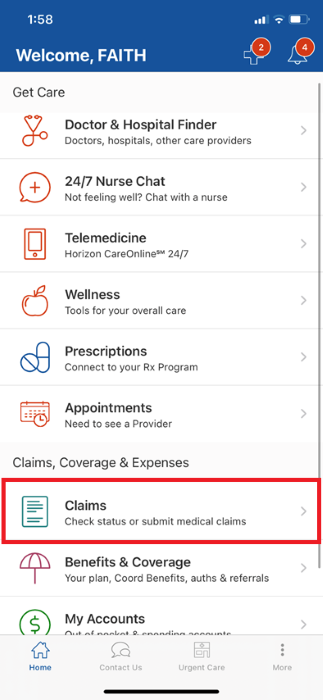

Yes. The Horizon Blue app provides you with 24/7 access to care, support and plan information from your smartphone or other mobile device.

To get the app, text GetApp to 422-272 or visit the App Store® or Google Play™. There is no cost to download the Horizon Blue app, but rates from your wireless carrier may apply.

To sign in to the app, enter the username and password that you used to register for HorizonBlue.com and click Sign In. Biometric sign in (fingerprint or facial recognition) is also an option.

With the Horizon Blue app, you can:

- Submit out-of-network medical and behavioral health claims.

- Display, download, print and share your member ID card.

- Quickly connect with health care professionals.

- View your claims, see how much your health plan paid, and any amount you may owe.

- Find doctors and hospitals.

- Check if a specific treatment or service is covered.

- Track your deductible, if applicable, and maximum out-of-pocket costs.

- Email or chat with a Member Services Representative to get answers to your questions.

- If you purchased insurance for yourself or your family directly through Horizon or through the NJ state-based exchange (SBE), you can pay your premium bill online and set up Auto Pay.

Was this helpful?

Last updated:

Jan 19,2024

Categories:

Topics:

Audience:

-

Choose the type of claim you'd like to submit.

-

You can submit out-of-network medical and behavioral claims using the Horizon Blue App or by mail.

Horizon Blue App:

To submit these claims using the Horizon Blue App, sign in to the Horizon Blue App and tap Claims, then Submit a Claim. Please note that this option is available on the Horizon Blue App only, not our website.

By Mail:

To submit these claims by mail, please include the appropriate claim form below and mail it, and the required information listed on the form, to the address on the form:

- Merck members: Merck Health Insurance Claim Form

- Organon members: Organon Health Insurance Claim Form

- State Health Benefit Program (SHBP) and School Employees’ Health Benefits Program (SEHBP) members: SHBP/SEHBP Medical Plan Claim Form

- All other members: Horizon Health Insurance Claim Form

-

- Under Doctors & Care, click Prescriptions.

- If you see Go to Prime Therapeutics: Mail the Prescription Drug Claim Form, and the required information listed on the form, to the address on the form. If you do NOT see Go to Prime Therapeutics: Follow the instructions on screen to be redirected to the appropriate vendor’s website, where you can find information about submitting prescription claims.

-

Complete the Claim Form - Dental and mail it, and the required information listed on the form, to the address on the form. You can submit out-of-network dental claims by mail only.

-

- Click Vision under Doctors & Care.

- Follow the instructions on screen to be redirected to the appropriate vendor’s website, where you can locate information about submitting vision claims.

Was this helpful?

Last updated:

Sep 29,2023

Categories:

Audience:

-

-

A copayment is the fixed amount you must pay after you’ve paid the deductible for each medical visit to a participating doctor or other health care provider, usually at the time of service.

Understanding Copayments

Transcript

Understanding what you pay for your health care is an important part of understanding your coverage.

Your copayment is a fixed dollar amount you pay each time you get care from your doctor, another type of health care professional or a hospital. Your copayment amount can vary depending on the type of health plan you have and which doctor, specialists or hospital you see.

Let’s see how a copayment works.

Sarah has a sore throat and gets an appointment with her in-network family doctor. At the doctor’s office, she pays the copayment amount listed on the front of her member ID card. For Sarah’s plan, the copay is $10 for an in-network family doctor. Once the claim is submitted by her in-network family doctor and processed by Horizon Blue Cross Blue Shield of New Jersey, an Explanation of Benefits statement or EOB is generated. The EOB shows how much her plan paid, how much she paid for her copayment and how much she owes for the visit if applicable.

What you need to know about copayments?

Your copayment amounts differ depending on the type of doctor, hospital or other health care professional you visit.

For example, the copayment to see a specialist in your plan may be higher than the copayment to see your primary care physician. Your copayment may also differ if you go out-of-network. Copayments are one component of your out-of-pocket expenses. Other out-of-pocket expenses may include your coinsurance, annual deductible and the cost for services not covered by your plan.

Copayments, coinsurance and deductibles: Understanding the differences.

Your plan could have a copayment, coinsurance or annual deductible. It does not always include all three.

Copayment. What you pay each time you receive care.

Coinsurance. What you pay after you’ve met your deductible.

Deductible. What you pay before your health insurance kicks in.

What is my maximum out-of-pocket?

Your maximum out-of-pocket is the highest amount you will have to pay each year. Once you meet your maximum out-of-pocket, your insurance will pay in full for all covered services and you will no longer pay a copayment, coinsurance or a deductible for the remainder of the plan year.

Maximum out-of-pocket can vary depending on type of plan and the number of dependents covered.

To learn more about your out-of-pocket costs and your health insurance benefits, visit HorizonBlue.com/understanding-your-costs.

If you need help finding information about your benefits, claim status and more, sign in to our secure Member Online Services at HorizonBlue.com to: read our FAQs, send us a question through our secure email or ask a question through Chat during normal business hours.

Horizon Blue Cross Blue Shield of New Jersey remains committed to helping you understand your benefits.

Was this helpful?

Last updated:

Feb 21,2024

Category:

Topic:

Audience:

-

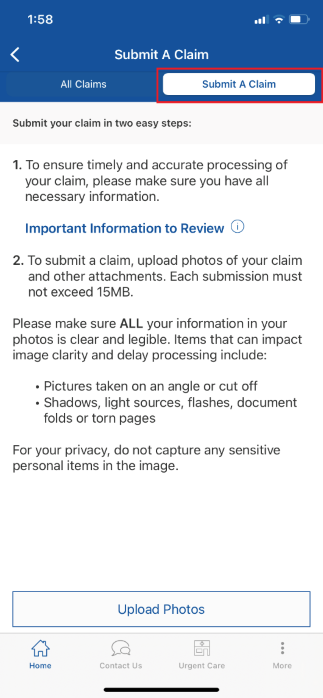

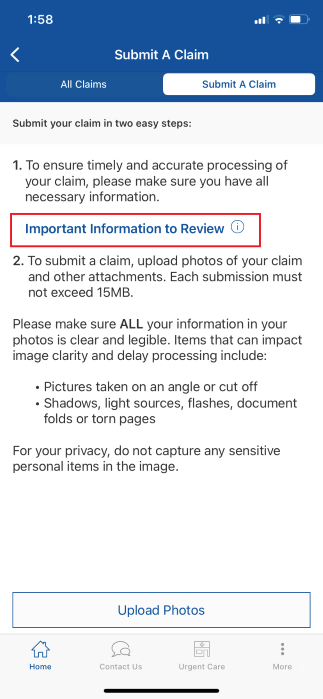

Submit your claim with the Horizon Blue App in a few easy steps:

-

When using the Horizon Blue App to submit a claim, you do not need to submit a claim form. However, you will need to photograph and submit an itemized bill or receipt.

-

When you open the Horizon Blue App, tap Claims, then Submit a Claim.

-

-

-

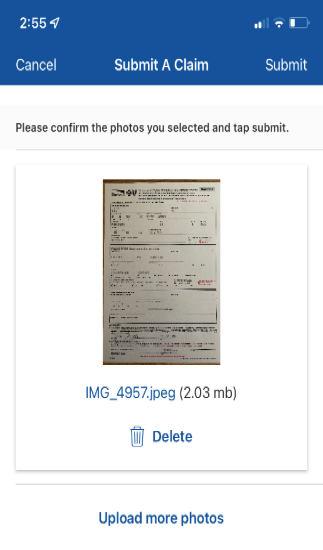

Upload photos of your itemized bill or receipts.

You can also upload any other supporting documents. You can submit multiple images per claim.

Please note: You cannot use the Horizon Blue App to take pictures. You’ll need to import them from another source, such as your phone’s photo library.

-

Before you submit your claim, you'll be asked to confirm the photos you selected. See the example below:

Was this helpful?

Last updated:

Nov 03,2022

Categories:

Topics:

Audience:

-

-

Coinsurance is the percentage you pay for a covered medical treatment or service after you’ve paid your deductible. The amount of your coinsurance depends on the type of medical care or service you receive and your specific plan. It is usually shown as a percentage of the overall cost of the service or treatment.

Understanding Coinsurance

Transcript

Understanding what you pay for your health care is an important part of understanding your coverage.

This short video explains what coinsurance is and how it works.

Let’s get started.

What is coinsurance? Coinsurance is the percentage you pay for a covered medical treatment or service after you’ve paid your deductible. The amount of your coinsurance depends on the type of medical care or service you receive and your specific plan. It is usually shown as a percentage of the overall cost of the service or treatment.

Here’s how it works.

John goes to the doctor to treat his strep throat and has a coinsurance of 20% when seeing his in-network primary care physician. John’s insurance has a $100 allowed amount for this type of in-network doctor’s office visit. Since John has a plan with a 20% coinsurance, John has to pay 20% of the $100 charge for his office visit OR $20. His insurance plan pays the rest OR $80.

Deductibles, coinsurance and copayments – understanding the differences.

Your plan can have an annual deductible, coinsurance and/or a copayment. It does not always include all three.

An annual deductible is the amount you have to pay during one benefit year before your health insurance starts paying for eligible medical treatment and services.

Coinsurance is the percentage of the costs for covered care that you have to pay.

Your copayment is the set amount you pay each time you receive care for a covered benefit. If your plan includes a copayment for services, it will not include a coinsurance for the same service type.

What is my maximum out-of-pocket?

Your maximum out-of-pocket is the highest amount you will have to pay each year. Once you meet your maximum out-of-pocket, your insurance will pay in full for all covered services and you will no longer pay a copayment, deductible or coinsurance for the remainder of the plan year.

To learn more about your copayment, deductible and coinsurance, sign into Member Online Services at HorizonBlue.com.

Need more help?

If you need help finding information about your benefits, claim status and more, sign into our secure Member Online Services on HorizonBlue.com to: read our FAQs, send us a question through our secure email OR ask a question through Live Chat.

Horizon Blue Cross Blue Shield of New Jersey remains committed to helping you understand your benefits.

Thank you for watching.

Was this helpful?

Last updated:

Feb 21,2024

Category:

Topic:

Audience:

-

While supplies last, you can order four at-home COVID-19 test kits per household for free from the federal government.

Was this helpful?

Last updated:

Mar 13,2024

Category:

Topics:

Audience:

-

It depends on how you got your coverage and when you’re trying to make a change.

If you bought your insurance from Get Covered NJ (the state-based exchange) or directly from Horizon:

You can change your coverage:

- During the Open Enrollment Period: November 1 through January 31.

- If you experience a qualifying life event at any time during the year. You are required to provide proof of the life event and the changes to your coverage within 60 days after the event.

If you are an SHBP/SEHBP retiree:

Contact the Division of Pensions and Benefits.

If you get your insurance through work:

Check with your benefits administrator or human resources department. Normally, you can only make changes to your coverage during the Open Enrollment Period or when you have a qualifying life event.

Was this helpful?

Last updated:

Nov 22,2023

Category:

Topic:

Audience:

-

Only members who bought their insurance directly from Horizon will be able to view tax documents online when selecting Document Center, then Tax Documents. We mailed your Form 1095-B sometime in late January or early February.

All other members:

- If you bought insurance through GetCoveredNJ, you will receive Form 1095-A from the State. Please contact GetCoveredNJ directly if you have any questions.

- If you have insurance through your employer, you will receive Form 1095-C from your employer. Please contact your employer directly if you have any questions.

- If you don’t have fully insured coverage from Horizon1, you will receive a different 1095 form from your employer or federal government.

1If you do not have fully insured health coverage from Horizon, you will see a “provides administrative services only and does not assume any financial risk” on the back of your member ID card.

Contact your tax advisor, attorney or consult the IRS for additional questions. Horizon cannot provide tax advice.

Was this helpful?

Last updated:

Feb 21,2024

Category:

Topics:

Audience:

Related FAQs

Quick Links

Browse these popular categories to find what you are looking for.

Can't Find an Answer to Your Question?

Browse our Help Center categories and topics. For questions about your medical plan or technical support, sign in to send us an email or start a live chat. For other questions, visit the Contact Us information page on HorizonBlue.com.